take home pay calculator manitoba

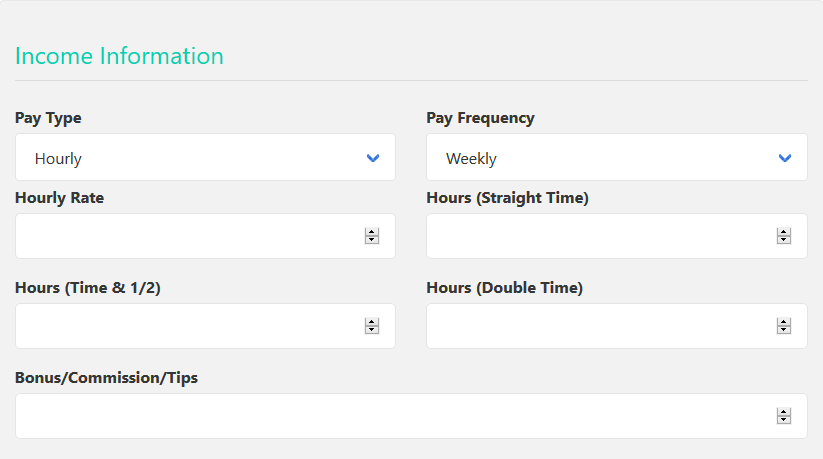

It can also be used to help fill steps 3 and 4 of a W-4 form. The net annual take-home salary as per new tax regime will therefore be.

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation

The average income in Manitoba for adults over the age of 16 is 45300.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in. Manitobas marginal tax rate increases as your. If you earn more than 34431 but less than 74416 your income above 34431 will be taxed at.

Personal Income Tax Calculator - 2020 Select Province. Additional Claims T1213 Pay Frequency. Use this calculator to.

This calculator shows how much youre REALLY making after-tax after work-related-expense takehome from each hour you work both paid and unpaid. The provincial income tax rate in Manitoba is progressive and ranges from 108 to 174 while federal income tax rates range from 15 to 33 depending on your income. Use the payroll deductions online calculator pdoc to calculate federal provincial except for quebec and.

Personal Income Tax Calculator - 2021 Select Province. This works out to be 1742 per biweekly. Manitoba take-home pay estimates What is the average salary in Manitoba.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Manitoba Income Tax Salary Calculator is updated 202223 tax year. Just select your province enter your gross salary choose at what frequency youre.

Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children Spouse 4 Children Other. Here you can determine the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amountThis payroll calculator. Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon.

That means that your net pay will be 37957 per year or 3163 per month. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia. The lowest tax rate in Manitoba is 108 for individuals who earn 34431 or less in one year.

Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example imagine someone earns 15 per hour in Manitoba works an. You can figure out your take-home salary in just a few clicks using our Canadian salary calculator. The tax rates in Manitoba range from 108 to 174 of income and the combined federal and provincial tax rate is between 258 and 504.

The manitoba income tax salary calculator is updated 202223 tax year. The average annual salary is 45300 for workers over 16 years old in Manitoba. The calculator is updated with the tax rates of all Canadian provinces and.

You can use the calculator to compare your salaries between 2017 and 2022. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

2022 Manitoba Income Tax Calculator Turbotax Canada

95000 Income Tax Calculator Manitoba Canada 2020

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Mathematics For Work And Everyday Life

2022 Manitoba Tax Calculator Ca Icalculator

Pay Cut Google Employees Who Work From Home Could Lose Money Reuters

Form W 4 And Your Take Home Pay Turbotax Tax Tips Videos

Free Paycheck Calculator Hourly Salary Usa Dremployee

2022 Capital Gains Tax Calculator Short Term Long Term

2021 2022 Income Tax Calculator Canada Wowa Ca

How Do I Calculate My Income Tax Deduction From My Paystub R Personalfinancecanada

How Investors Use Price To Rent Ratio To Evaluate Properties

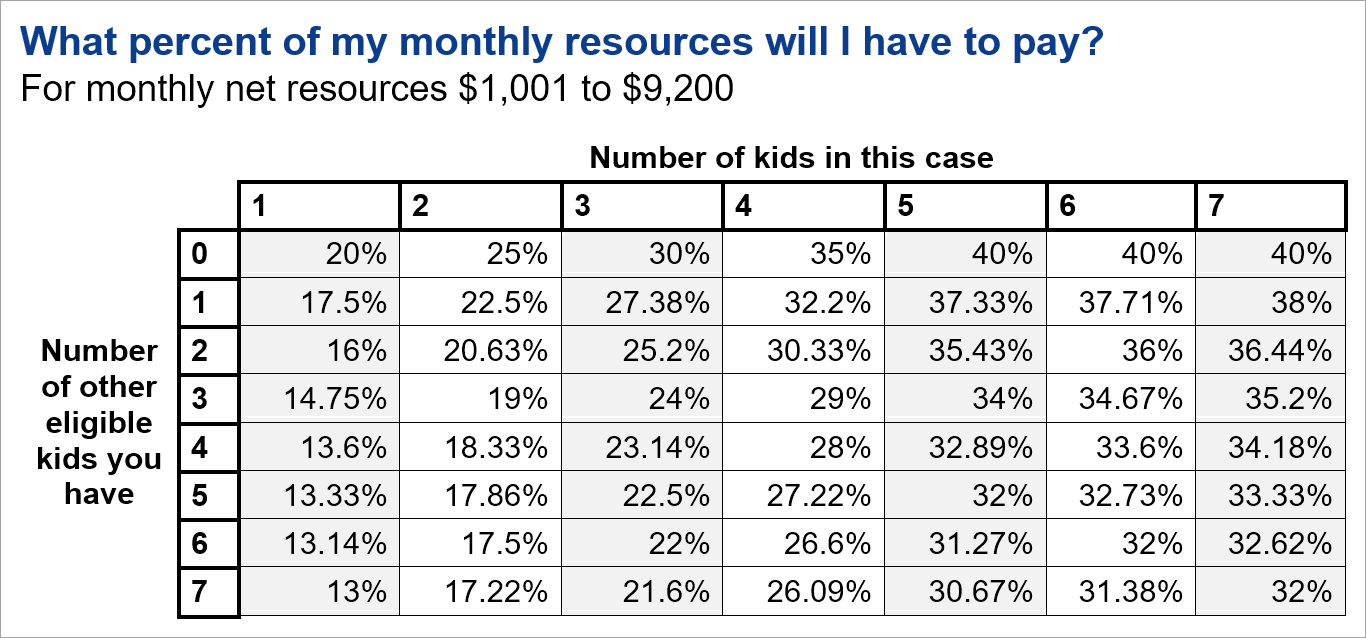

The Easiest Texas Child Support Calculator Instant Live

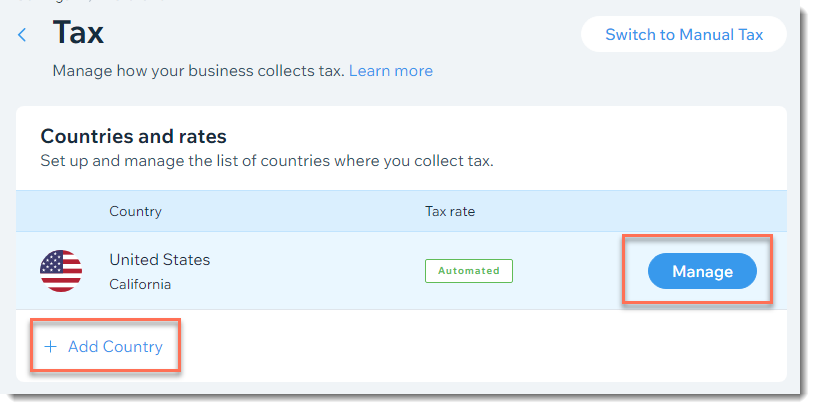

Wix Stores Setting Up Automatic Tax Calculation With Avalara Help Center Wix Com

Mathematics For Work And Everyday Life

Free Online Paycheck Calculator Calculate Take Home Pay 2022

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

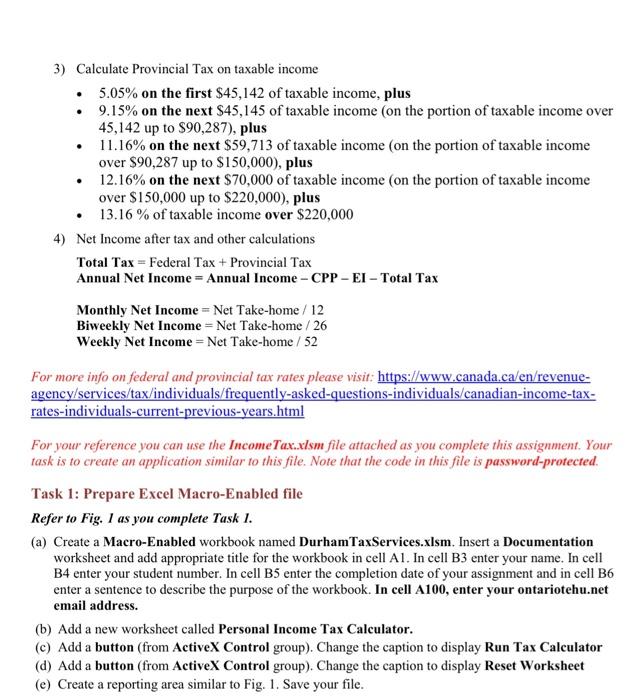

Solved Personal Income Tax Calculator Data File Needed For Chegg Com